- EXPLANATION

- FISCAL RESPONSIBILITY

- INVESTMENT CALCULATOR

- FREQUENTLY ASKED QUESTIONS

- SPENDING PLAN

- INFORMATION AND RESOURCES

- UNDERSTANDING THE BALLOT QUESTION

A Determination of Fate for Lowell and the Tri-Creek School Community

On May 2, 2023, residents residing within the Tri-Creek School Corporation will have the opportunity to decide whether or not to invest in our schools, students, and the greater community by voting on an operating referendum question that will directly impact the quality of education—and property values in addition to the type of home buyer seeking to relocate in our growing town. This investment equates to 20.5 cents per $100 of assessed property value. For most homeowners, this will result in a 4%-11% increase on only the school portion of property tax. If passed, the referendum term is for eight years and represents the maximum amount allowed for the term. The school district may, however, actually levy less should revenue significantly increase from other sources such as state tuition support and in the absence of other detrimental factors.

PROPERTY TAX: Tax Cap and "Circuit Breaker" Effect

In the past three years, Tri-Creek schools has lost out on over $1.1 million as a result of the property tax cap. This is referred to as the "circuit breaker" effect. While this is great for home, business, and property owners, the unintended outcome has negatively impacted Tri-Creek schools and will only continue to get worse. According to the Department of Local Government Finance, the amount of revenue loss for 2023 is estimated to be $589,780—more than half of the past three years combined. This is tax money that would have normally been received by our schools but is no longer. As a result, Tri-Creek schools is in need of additional revenue to sustain programming.

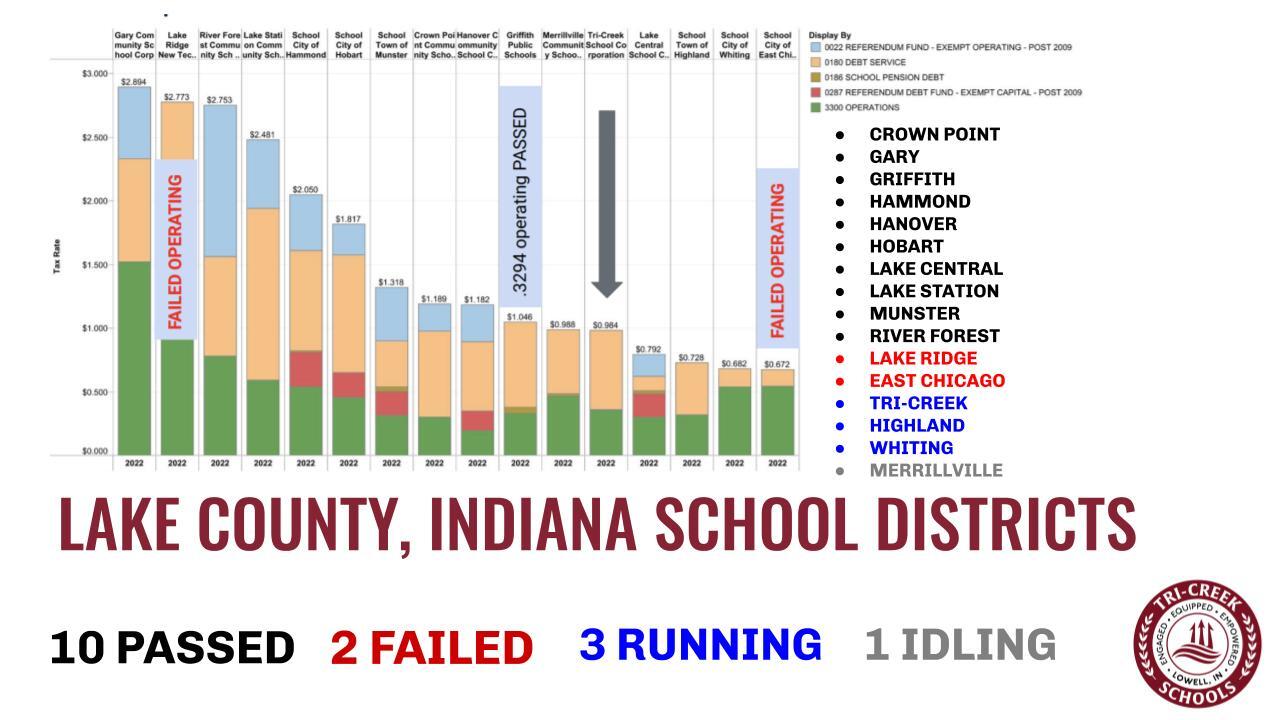

Tri-Creek School Corporation is not alone. Out of 16 public school districts in Lake County, Indiana, all 16 have either passed operating referendums, failed, or intend to pursue referendums in order to survive. Tri-Creek currently ranks in the Top 25% in Indiana for student academic performance but in the bottom 20% for state tuition support per student. This will most certainly change in a negative way if the heart and soul of our greater Lowell community —its schools— loses staff, is forced to cut student programs, and cannot recruit quality personnel to teach and support kids.

INVESTMENT PLAN: Three Areas

-

Avoid layoffs. Retain staff for important student programs.

-

Keep staff from leaving for other school districts that have passed referendums as well as recruiting quality staff to fill open positions. Competitive wages are critical in the competition for employees.

-

Programming to enhance school safety, behavior programs, instructional coaching, tech integration, manageable class sizes, and service to the community by the ability to offer preschool programs. These are programs that keep Tri-Creek students as the leader in the region as well as the state.

You can learn more about the specific items on the Tri-Creek Teaching and Safety Plan by clicking here.

FINANCIAL IMPACT ON RESIDENTS: How Much?

The proposed referendum will be at a rate of $0.2050 per $100 of assessed value – a rate increase in only the School Property Tax Levy portion of the annual tax statement. The Investment Calculator tab above allows individuals to explore the specific amount on any given property.

IF COMMUNITY SUPPORT FOR SCHOOLS PREVAILS: Anticipated Outcomes

-

Property values remain at optimal levels by supporting schools that provide a quality education (people who've invested lifelong savings in their homes are proud of the increased value as a return on the investment)

-

Retain and grow quality staff

-

Quality schools attract quality people to the growing community

-

Community pride is a by-product of quality schools and student programs

-

Students who continue to give back to the community through charitable giving projects, student apprenticeships, and partnerships in community events

IF THE COMMUNITY DECIDES NOT TO SUPPORT THE SCHOOLS: Anticipated Outcomes

-

Staff layoffs resulting in a loss of student programs

-

Veteran staff will leave to work in other school districts with passed referendums or leave education altogether for vocations that pay more

-

Inability to recruit quality staff and new talent

-

Lower property values

-

Lesser quality of education for the youth of Lowell and surrounding communities

FISCAL RESPONSIBILITY: Efforts to Maximize Tax-Payer Resources

-

Solar Panel Installation. Over the life of the panels, the district will pay off the entire General Obligation Bond (principal & interest) AND save an estimated $3,250,000 above that in Operations expenses.

-

By forming an insurance trust for employee healthcare, Tri-Creek schools only realized a 2% increase in premiums while other schools experienced anywhere from an 8%—12% premium increase.

-

Installation of LED lighting and updates to more efficient heating and cooling technologies at all three elementary schools.

-

Avoiding approximately $450,000 in costs by maximizing district resources and not installing mobile classrooms during the Lake Prairie Elementary classroom addition project.

-

Leveraging bond money without raising the tax rate for a $95 million district-wide improvement project to ensure campuses meet the needs of students and the community— and with pride.

-

Creating an intermediate school of grades five and six exclusive and separate from a middle school of grades seven and eight under one roof beginning with the 2024-2025 school year— a project that will maximize the current middle school building so that classrooms are not empty and that will eliminate the need to spend millions on additional classroom, cafeteria, and gymnasium expansions at Oak Hill and Three Creeks elementary schools.

-

Getting out of the sewer mound business of costly repairs and upkeep by partnering with the Town of Lowell to extend city sewer service to Lake Prairie— a project that will save the school district money for years to come and encourage economic development along the US 41 corridor through the joint buying power of a single task with a dual benefit.

Tri-Creek School Corporation endeavors to be totally transparent regarding the financial impact on every property owner. For this reason, the investment calculator has been developed for reference and may be accessed by clicking on the below link.

Please note, in order to better serve our community and to further clarify the percentage impact year over year, the investment calculator has been updated as of March 16, 2023, to include the ability to select your taxing district and to calculate the estimated percentage impact for your property value.

2023 Operating Referendum Investment Calculator

Tri-Creek Teaching and Security Program Spending Plan

Below you can find information on the personnel and positions covered in the Tri-Creek Teaching and Security Program Spending plan as a part of the 2023 Operating Referendum. Click here to view details about each of the line items listed below.

|

Recruit and Retain High Quality Teachers and Staff |

$3,000,000 |

|---|---|

|

Grant-Funded Aides - 9 Aides |

$103,701 |

|

Grant-Funded Counselor |

$83,743 |

| Grant-Funded Teacher - 4 Teachers | $310,602 |

| Grant-Funded Deans - 2 Deans | $182,411 |

| Grant-Funded Health Aide | $33,565 |

| Safety - Grant-Funded Behavioral Aide |

$52,000 |

| Additional Certified Staff - Class Size Reduction - 5 Teachers | $472,453 |

| Instructional Coaches - 4 Coaches | $436,354 |

| Technology Integration Specialists - 2 Specialists | $218,177 |

| Safety - Behavior Specialists (3 buildings) | $137,152 |

| Safety - School Resource Officers - 5 Part-Time SROs | $116,262 |

| Maintenance & Grounds Personnel - 2 Groundspeople | $92,977 |

| Total Estimated Annual Cost | $5,239,396 |

Recruit and Retain High Quality Staff - $3,000,000

This line supports the recruitment of staff for the following programs, such as:

- Preschool program, additional staff in the areas of 1 teacher for Construction Trades, 1 teacher for Trades (Automotive and/or Machining), 3 teachers for STEM at elementary, and sustaining behavior intervention programs at elementary schools with expansion to middle and high schools.

- This line also supports the retention of our high quality staff (teaching and support staff) by being competitive with our local school districts. The percentage increase is subject to the negotiation process with the teachers’ union.

- Extra-curricular and curricular needs based on student interests.

Grant-Funded Aides - $103,701

- 9 instructional assistants who work closely with students in classrooms throughout the day. They help assist students in one-on-one and small group instruction for special education requirements, remediation, and catching students up from absenteeism. Assistants also help with the supervision of students.

Grant-Funded Counselor - $83,743

- 1 student guidance counselor at the high school during a time when the state requires students to choose a pathway for a diploma. This will lessen the time counselors have with students to focus on their interests, skills, strengths, and make a map of their future. Students are also coming to school with a lot of baggage and issues also experienced through social media. This is one less person to serve the needs of approximately 200+ students.

Grant-Funded Teachers - $310,602

- 4 teachers were hired to reduce class sizes in 2020-2021 and have continued to be necessary.

Grant-Funded Deans - $182,411

- 2 students' deans who currently work to keep schools orderly on a proactive level and provide behavior interventions and also address student misbehavior. Elimination of these positions will have an impact on taking principals away as instructional leaders to respond to student misbehavior and increased possible response to intervention that results in higher numbers of students identified as needing special education services.

Grant-Funded Health Aide - $33,565

- 1 district-wide health aide who assists the building-level nurses in compliance reporting of immunizations, substitutes for nurses when they themselves are ill, assists with workloads, and pivots throughout the district as needed to assist with emergency situations.

Additional Staff to Address Class Size - $472,453

- 5 additional teachers to reduce class sizes throughout the district.

Instructional Coaching - $436,354

- 4 Instructional Coaches to support teachers. There is a teacher shortage. People are getting emergency licenses just to fill vacancies. These individuals are in need of support as they did not go through formal teacher training or internships. Instructional coaches at the elementary and secondary levels will also be a support to professional learning communities with a focus on working to increase student growth and achievement for all. Professional development is essential not only in fields such as the medical and legal industries but is essential to the education profession as well.

Technology Integration - $218,177

- 2 Technology Integration Coaches to support teachers in integrating classroom technologies, model classroom instruction utilizing technology, increase adoption of instructional tools, and maximize the return on investment in our classroom technologies essential for meeting state testing requirements. This includes helping teachers in using technology not just as a substitution for other teaching and learning methods but as a way to redefine learning in ways traditional instruction could not.

Operations Personnel - $92,977

- 2 additional positions in Maintenance and Grounds.

Safety Behavioral Specialist - $137,152

- 1 Behavioral Specialist serving as coordinator and practitioner. This specifically relates to one of the premiere school programs in all of Lake and Porter counties. Tri-Creek has been a leader in this endeavor over the past year with great results in lower discipline referrals, fewer special education referrals, and a more orderly environment. These professionals work closely with the dean of students and student support advisors.

Safety Student Resource Officers - $116,262

- 5 School Resource Officers to expand the successful program that puts police officers in our schools to increase safety and build strong relationships with our students.

Safety Grant Funded Behavioral Aide - $52,000

- 2 Behavioral Instructional Aides were added in 2020-2021 to support teachers in classroom behavior and to provide students with a multi-tiered system of support.

People are necessary for quality student programs.

Retaining and recruiting quality personnel to offer education and specific programs to students is dependent upon the professionals and people themselves.

Below you can find the projected spending plan for the 2023 Operating Referendum. More detail can be found on the Spending Plan tab.

Tri-Creek Teaching and Security Program Spending Plan

|

Recruit and Retain High Quality Teachers and Staff |

$3,000,000 |

|---|---|

|

Grant-Funded Aides - 9 Aides |

$103,701 |

|

Grant-Funded Counselor |

$83,743 |

| Grant-Funded Teachers - 4 Teachers | $310,602 |

| Grant-Funded Deans - 2 Deans | $182,411 |

| Grant-Funded Health Aide | $33,565 |

| Safety - Grant-Funded Behavioral Aide |

$52,000 |

| Additional Certified Staff - Class Size Reduction - 5 Teachers | $472,453 |

| Instructional Coaches - 4 Coaches | $436,354 |

| Technology Integration Specialists - 2 Specialists | $218,177 |

| Safety - Behavior Specialists (3 buildings) | $137,152 |

| Safety - School Resource Officers - 5 Part-Time SROs | $116,262 |

| Maintenance & Grounds Personnel - 2 Groundspeople | $92,977 |

| Total Estimated Annual Cost | $5,239,396 |

Referendum Presentation (Social Media Link)

The below linked slide presentation is a resource used to educate staff and the community about the reason for a school operations referendum.

AN OPERATIONS REFERENDUM: “YES” or “NO”

On May 2, 2023, voters throughout the school district will go to the polls to vote “yes” or “no” regarding an Operating Referendum. Outcome of the election will determine the fate of future staff, student programs, safety programs, and overall quality of schools and community.

The investment is an additional 8 cents per $100 of assessed – not market – value on residential and business property. Tri-Creek schools rank the 11th lowest in school tax rates out of 16 public school districts in Lake County, Indiana.

Currently at a tax rate of $1.055, if the community votes “yes” to support students, teachers, and staff who live and work locally, the tax rate will rise to approximately $1.135 beginning in January 2024 – an increase of 8 cents.

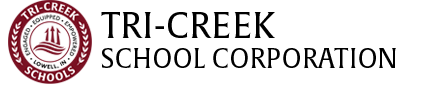

Tri-Creek schools want community members to understand the school tax rate year after year for an easier comparison. Below is a visual that helps to explain this calculation.

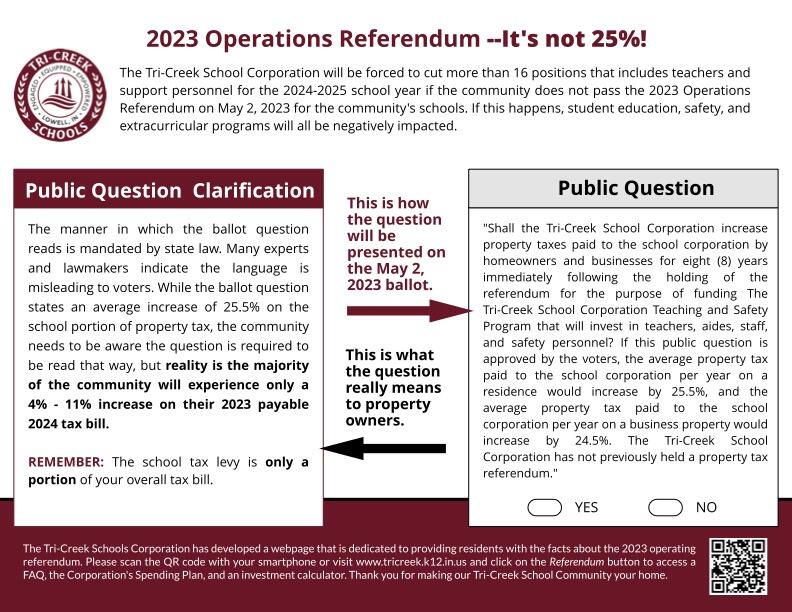

VOTERS TAKE NOTE

The ballot question references a school property tax increase of “25.5% for homeowners and 24.5% for business property." While the school portion of property tax bills is often the largest portion, the $0.205 per $100 of assessed value – not market value – is only for the school portion of the overall tax bill. The percentages referenced in the ballot question is an estimated average of what schools will take in – not the actual increase.

Tri-Creek schools want community members to understand the school tax rate year after year for an easier comparison. Again, for 2023, the school tax rate is $1.055. For 2024, the school tax rate is estimated to be $0.93 due to debt “falling off” the books. If the school operating referendum passes, the 0.205 is added to the approximate $0.93 for an estimated total of $1.135 in 2024. Take the anticipated 2024 school tax rate of $1.135 and subtract the 2023 school tax rate of $1.055 and the outcome is a difference of $0.08. An increase of 8 cents on the rate does not equate to a 25% increase for 2024 over 2023.

This site provides information using PDF, visit this link to download the Adobe Acrobat Reader DC software.